[one_half]

Foresight & Insight

Looking at Transforming Markets

To continue growing and adapting through turbulent and rapidly shifting economic and social conditions, Scotiabank required a deep understanding of the future of a new market sector.

![]()

Scope of work

- Horizon Scan

- Scenario planning

- Trends impact analysis

- Engagement

- Strategic implications

[supsystic-social-sharing id='1']

[/one_half]

[one_half_last]

Scotiabank is the third largest bank in Canada by deposits and market capitalization. It serves 19 million customers in 55 countries and offers a broad range of services including personal, commercial, corporate and investment banking. It has assets of over $750 billion.

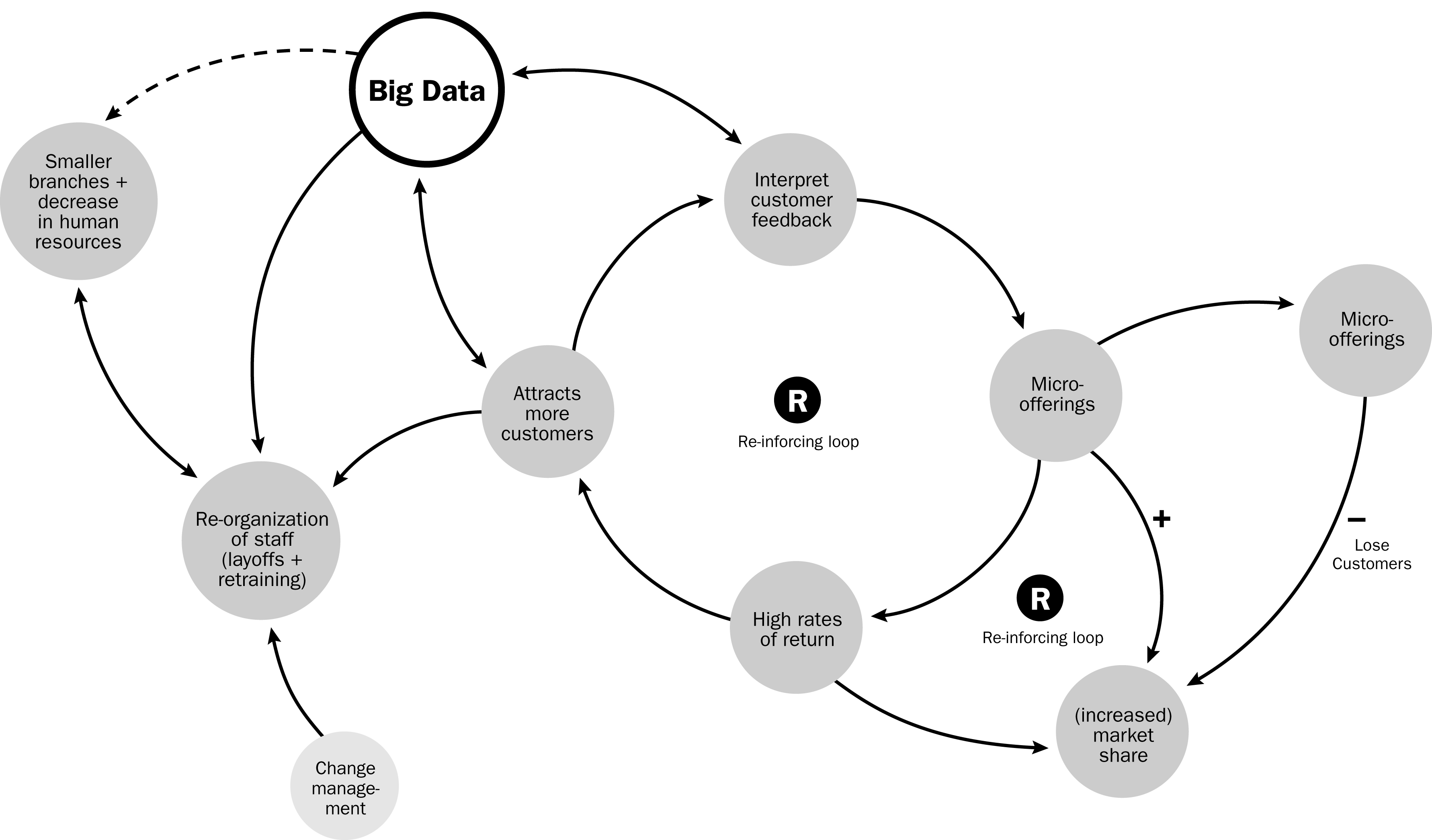

In order to continue to grow and adapt through turbulent and rapidly shifting economic and social conditions, Scotiabank required deep understanding of the future of a new market sector. We were asked to outline possible realities for both Scotiabank and a particular group of Canadians ten years into the future. This work involved deep research and facilitated engagement of key stakeholders.

The research, workshops, reports, discussions and material we provided prepared Scotiabank for a more detailed examination of some of the characteristics of three personified customers (‘personas’). We investigated the impacts of potential futures on their lives and their banking needs, and specifically how that might provide opportunities Scotiabank’s banking offerings.

It was important for Scotiabank to suspend their objections as to whether or not the future would unfold exactly as described in the narratives we outlined. We used logical constructs as a tool to imagine how things might be different in the future. We looked for opportunities and threats to Scotiabank’s business through the lens of human centered changes in behaviour, values and social systems.

We met with 20 senior leaders at the bank in six different departments. We interviewed 40 representative customers in person or by phone. We conducted 2 highly successful workshops, analyzed significant quantitative data and created data visualization tools that identified several key insights.

We delivered a 90 page written report and gave three presentations of our findings to senior leadership. The report provided the groundwork to explore innovative approaches to the development of new and appropriate products, services and spaces to meet the potential future needs of the identified market sector with respect to their financial well being and their changing lives.

Strategic alternatives to current practice were uncovered that will allow the bank to expand it’s offerings and better serve this transforming segment. This will mean that Scotiabank is preferentially positioned to gain traction with this audience.

[/one_half_last]

No Comments.